“Life can only be understood in retrospect, but can only be lived going forward.”

– Nicholas Sergio

Inflation and Interest Rates

“U.S inflation is the highest in 13 years.” – WSJ, June 10, 2021

“Consumer prices rise 5% over last year, fastest rate since 2008.” – CBS News, June 10, 2021

“Inflation is rising and that probably isn’t a good thing for stocks, says 60 years of data.” – Yahoo Finance, June 7, 2021

Wow, those are some scary headlines. The same sort of fearful media headlines we all witnessed during the peak of the Pandemic. Ladies and gentlemen, these types of headlines, yet important, should be always viewed with a high degree of skepticism and caution since they tend to appeal to the emotional side of human nature. Yes, inflation is present and it should be after $6 trillion in government spending and stimulus. If we had no inflation, it would suggest the economy is in big trouble. A little over a year ago, the entire world was shut down, locked down and placed into isolation – and then suddenly reopened. Furloughed factories had to restart, raw materials had to be ordered, employees had to be hired and so forth. Furthering the impact, you have to consider today’s financially healthy American consumer that accumulated over $10 trillion dollars in household net worth and is eager to spend money and get back to living their lives. This is exactly what has happened since COVID vaccines were distributed and fears abated. In our opinion, most of the inflation we are witnessing today will be transitory and should be of no surprise; it’s more of a reaction and result to massive government spending, lockdowns and shutdowns of our economy. As we fully reopen, we will see some inflation points like wages remaining elevated, while other points such as building supplies should level off and return back to more normal levels. Mild inflation and a strong economy are a good thing. The opposite is deflation and a weak economy similar to what was experienced during the COVID lockdown period. Deflation is not good for U.S. households and businesses and should be avoided at all costs. Below is the U.S. Ten-Year Treasury Note which is a very good proxy for gauging inflation and deflation. As you can see, the interest rate on the Ten-Year Treasury has actually backed off its post-COVID highs despite the continued negative headlines about inflation. Is this a potential sign that the fixed income markets believe that inflation will be moderate?

Source: MetaStock.com

Dow Theory Buy Signal

For the second time in 2021, we have experienced another Dow Theory Buy Signal during the month of May. A Dow Theory Buy Signal is when the Dow Jones Industrial Average and the Dow Jones Transportation Index register new highs, in this case all-time new highs. This is a healthy sign for potentially higher prices in the intermediate and longer-term time frames.

Source: StockCharts.com

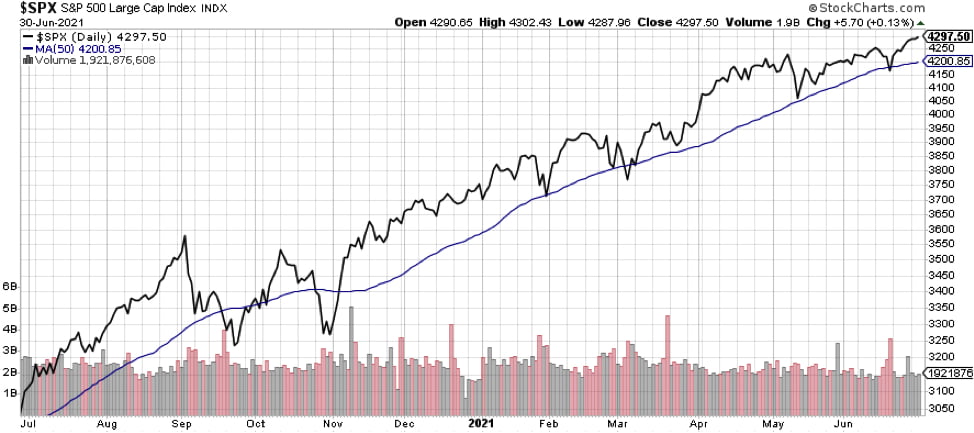

Volatility, S&P 500 and the NASDAQ Composite Indexes

Volatility has collapsed during 2021 and continued to hit new lows for the year during the second quarter. With every rally in volatility, we have witnessed a series of lower highs and lower lows. This is another healthy sign for the equity markets moving forward. During this same time frame, we have also witnessed the S&P 500 and NASADQ Composite Indexes break out to all-time highs.

Source: StockCharts.com

Source: StockCharts.com

Source: StockCharts.com

Secular Bull Market

In closing, I still believe we are in the midst of a technology revolution that is transforming how we all live our lives and helping to fuel a large, protracted secular bull market. A secular bull market that has a foundation of an accommodative Federal Reserve, a healthy consumer, strong economy, expectations of strong S&P 500 earnings growth and low to moderately rising interest rates. This is a good formula for potentially higher markets in the intermediate and long-term time frames. While we do not expect markets to move higher in a straight line, we may experience the occasional 10 to 15% or larger corrections. At Banyan Wealth, my team and I always preach that there’s always plenty of background noise and distractions when investing. Being so, it’s critical to remember that investing is a marathon, not a sprint, and it’s always important to stay focused.