“Everything is based off of interest rates… It’s a huge, huge, huge gravitational pull and affects what I am doing.”

– Warren Buffett

The quote above is especially true today. Interest rate levels and risk assets go hand in hand. I often say that monetary policy is a key driver of risk assets. Let us flashback to my 2020 Second Quarter Insights at the very height of the financial markets meltdown where I penned “Speed, Stimulus and Support” would be the key to fighting the Global Pandemic, as well as the key to supporting financial assets which were in freefall. The US government unleashed a massive amount of stimulus that created the desired result on risk assets like bonds, real estate and equities, all soaring in price. What a good time it was to be an investor. Fast forward today and the Federal Reserve is operating a single mandate and that is the battle to fight inflation. The good news here is that inflation is lower and moving lower, though at a slow pace, and overtime should return to normal. The not-so-good-news in the short term is that monetary policy has moved the Federal Funds rate to 5.25% – 5.50% with the possibility of moving slightly higher over the next few meetings. But this is not all; the Federal Reserve, through quantitative tightening (QT), is also unwinding its enormous balance sheet of bonds purchased in 2020 during speed stimulus and support of the economy, placing additional pressures on interest rates in many markets. Interest rates are now near 20-year highs in residential mortgages. Interest rates are also higher in US Treasury bonds in all maturities this year with the US 10-Year Treasury Bond hitting the highest interest rate level since 2007. Oh, I also forgot to mention that since the beginning of the Ukraine conflict, China has sold $200 billion in US Treasuries in the last 17 months. With the Chinese economy softening, especially in real estate, and the Ukraine conflict continuing, I would expect them to keep selling and putting additional pressure on interest rates. Now, I do not write this to scare anyone, just to educate and make a simple but important point — monetary policy can have a profound effect on risk assets. It does not mean the markets will collapse; it simply means that it will take some time and multiple gyrations in many asset classes for markets to digest this restrictive monetary policy. Over the intermediate to long term, we are very confident that risk assets, like equities, will be higher. But in the short term, the markets will need to adjust to this tighter monetary policy.

Welcome to my insights and I hope you find them educational and informative as you invest for retirement, during retirement and wealth creation.

Pros and Cons

Below are some of the items we will be watching during the fourth quarter and into the first quarter of 2024.

PROS:

- Q4 seasonality

- The US employment picture appears to be very healthy in the US

- Inflation appears to have peaked

- The consumer appears healthy

- The emergence of AI technologies

CONS:

- The price of WTI Oil is now up 31% over the last three months. Diesel fuel is up 32% and Jet Fuel is up 38%.

- 30-year mortgage rates have soared to over 7.75% nationally and the highest levels last seen since 2007

- Strong US dollar

- Disinflation momentum has slower

- Higher rates for longer

- The Conference Board of Leading Economic Index is now negative for 17 consecutive months

The S&P 500 and the Equal Weight S&P 500

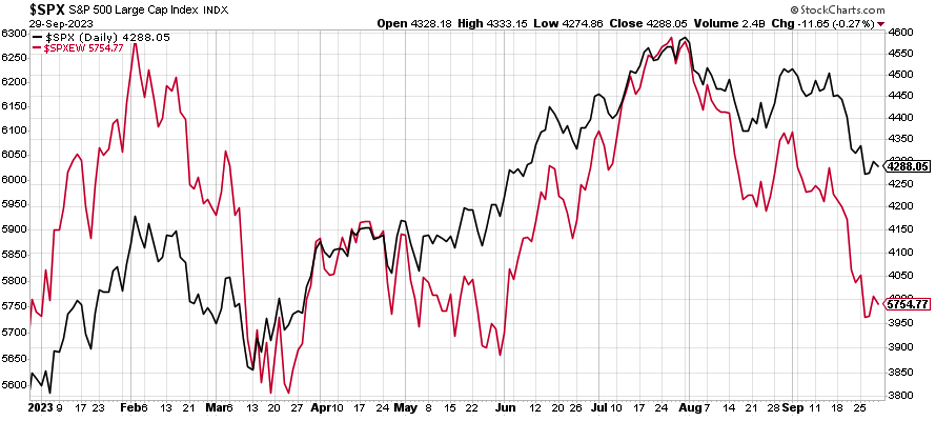

There are currently 503 companies in the S&P 500. Yes, that is correct, 503 companies. The S&P 500 is a market capitalization index that is dominated by roughly seven mega-cap technology companies that comprise a much larger index weighting than the 493 smaller market capitalization companies. The S&P 500 Equal Weight Index equally weights all stocks in the S&P 500. This year, the divergence between indexes is very large with the S&P 500 up 12% while the equal-weighted index has only gained a tiny 1%. This large performance disparity could be pointing to a market environment that is less healthy outside of the largest seven companies.

S&P 500 – Black Line

S&P 500 Equal Weight – Red Line

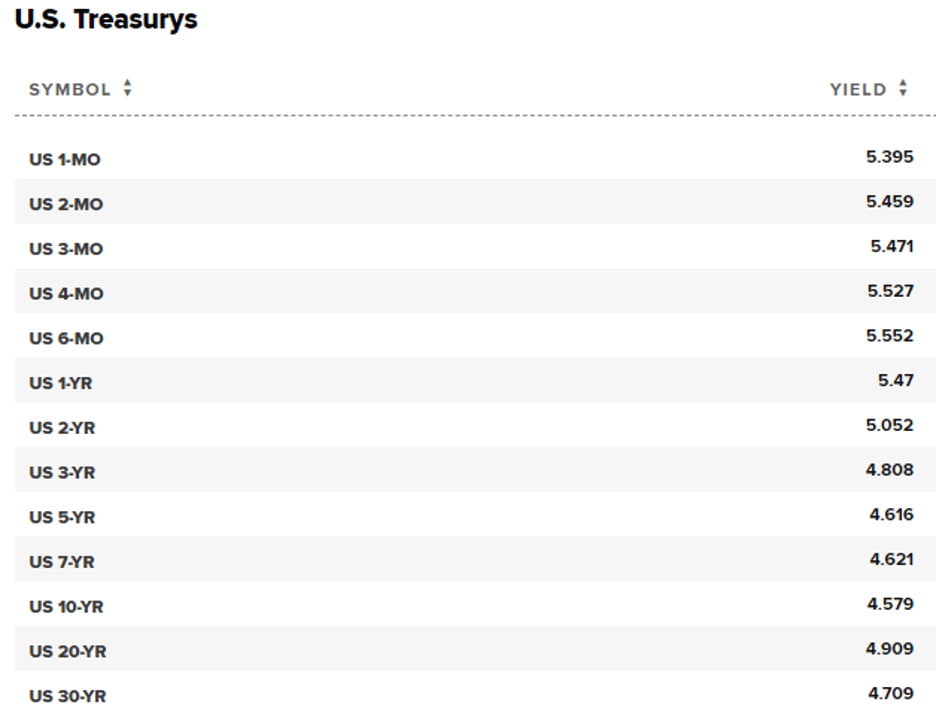

TIAA (also known as There is an Alternative)

With the S&P Dividend Yield only 1.62%, trading at 22 times earnings, and the Two-Year Treasury Bond yielding 5.05%, fixed income is beginning to look much more attractive than it was only 12 months ago. Below is the list of current yields on US Government Bonds. You cannot tell me that these rates are not competition for riskier assets. The notion of higher rates for a longer period appears to be creating an alternative to riskier assets.

Source:CNBC 9/29/3023

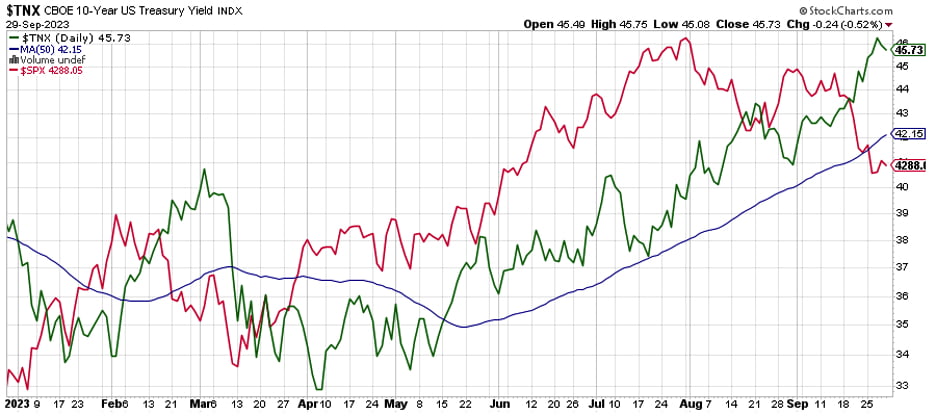

Ten-Year Treasury Yield vs. The S&P 500 Index

The recent increase of yields for Ten-Year Treasury Yield (Green) is having a negative effect on the S&P 500 (Red).

Secular Bull Market

Over the intermediate to long-term, we believe we are still in a large secular bull market. We also believe that over time, the S&P 500 will resume its secular bull market higher and eventually take out its 2022 highs. But, as always, we want to remind our readers that investing is a marathon and not a sprint; time and patience are extremely important in investing for retirement and wealth creation.