“History repeats itself. Same story, just a different script.”

– Nicholas Sergio

The government once again stepped in to stabilize markets during the first quarter of 2023 with the failure of two regional banks, Silicon Valley Bank and Silvergate Bank. With uncertainty and fear of a banking crisis spreading throughout the financial system, the Federal Reserve stepped in to guarantee the deposits of these two financial institutions and injected nearly another $400 billion for other banking institutions urgently in need of liquidity. Not to get too far into the details, but these two institutions flourished during COVID, benefiting from very loose monetary policy (zero interest rate policy (ZIRP)), the boom in technology and close ties to Crypto. The lack of risk management and the desire to make additional profits required both institutions to take unnecessary risk with depositor funds through duration mismatch. In essence, they secured short-term deposits with government bonds and federally backed mortgage securities that would not mature for a longer time period. When rates moved higher, those bonds traded lower, creating paper losses on the books of these institutions. Finance 101, government bonds and government back mortgage-based securities may not have default risk, but they do have interest rate risk. This is an unintended consequence of keeping rates low for too long, inflation and the massive amount of monetary policy that was injected into the system during COVID. For those that experienced the Savings and Loan Crisis of the 70’s and early 80’s, this is one of the behavior traits by financial institutions that was responsible for the closing of many savings and loan institutions. History repeats itself. Same story, just a different script.

S&P 500 – Are We at the Bottom? More Time is Needed

I thought we would update this chart from last quarter. While the markets have made some progress, it’s still too early to call if we have seen the lows in the S&P 500. With the Russell 2000 Small Cap Index struggling and banking/financial stocks experiencing a selloff in the first quarter, some of the market internals have been less than impressive. Bottoming processes take time and patience. The rarest asset in investing is patience.

Source: FactSet

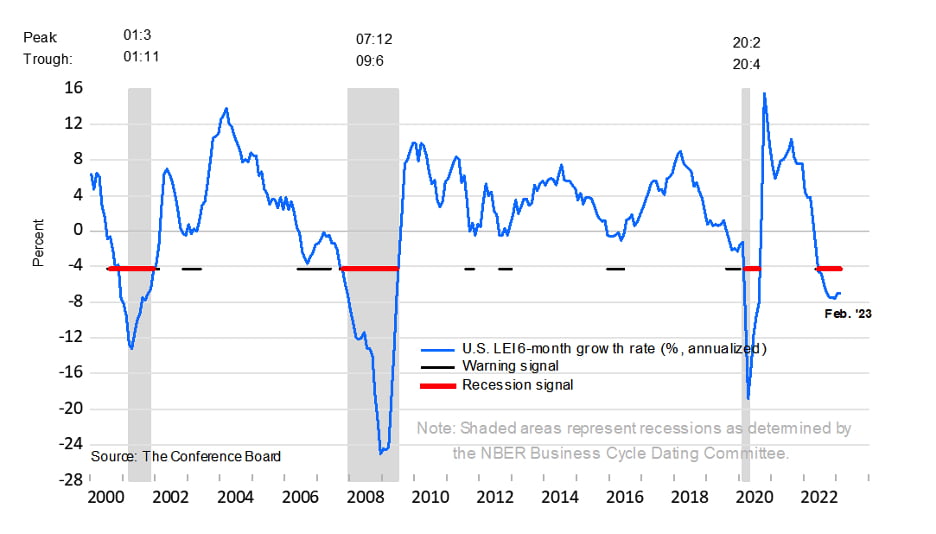

Leading Economic Indicators

The Conference Board Leading Economic Index looks to be bottoming and still signaling the possibility of a recession over the next 12 months. To expand on this, we have seen commodity prices weaken, bond prices move higher, yield curves continue their weakness and regional bank stocks come under significant price pressure. These are often signs of a recession in the offing.

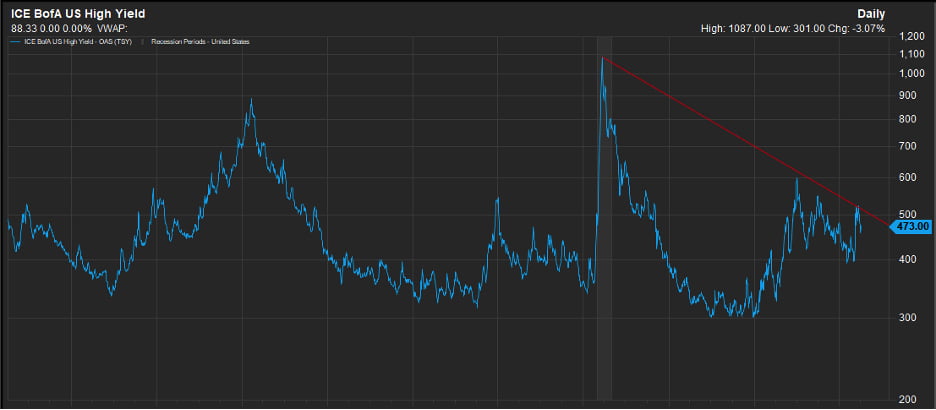

ICE BoA US High Yield Index Adjusted Spread

This index, which measures risk in the junk bond market, has moved higher in price but not significantly. It is at elevated levels and tends to peak around inflection points in the equity markets.

Source: FactSet

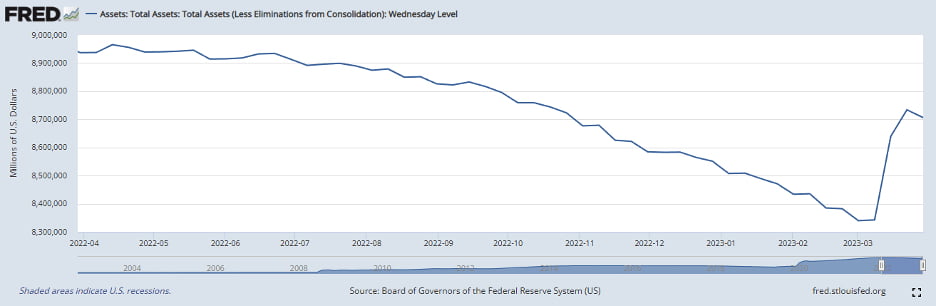

The Federal Reserve Balance Sheet

The Federal Reserve is once again adding to its balance sheet. This injection is adding liquidity to the financial system, specifically targeting regional banks and financial institutions that require a cash infusion to fulfill withdrawals. The Federal Reserve injected nearly $400 billion of liquidity into the financial system in March. This action is the opposite of quantitative tightening. Eventually, the Federal Reserve will need to reverse this additional liquidity and continue to reduce its nearly $9 trillion dollar balance sheet.

In Conclusion

If we are in or entering a recession, the average recessionary bear market duration for the S&P 500 is 13 months with an average price contraction of -33%. Currently, we are approximately 15 months into this bear market and have seen a maximum selloff of 25%, implying that we are closer to the end of this bear market than the beginning. Markets are forward-looking and tend to bottom prior to the economy and corporate earnings. There should be another bull market on the other side of this bear market lead by earnings, growth and innovation. So, do not lose focus. Remember that investing is a marathon and not a sprint. Stay calm, objective and long-term oriented.