“Do the job right the first time, so you do not have to come back a second time.”

– Nicolino Sergio

On June 1st, 2023, we lost my father at the age of 84 after a multi-month battle with health issues. My father was a proud man, immigrating here from Italy as a young man with nothing but a few dollars, a 6th grade education and a few skill traits in construction. He worked diligently to learn English, educated himself, labored long hours for the Plasterer’s Union and started a family. When I was just a baby, he started his own business and worked for several decades in the ceramic tile, marble, and plastering business in Northern New Jersey. As a young boy, I often accompanied him on long 10-hour days, performing various labor-intensive tasks. We worked long hot days in the summer and freezing cold and wet days in the winter. I learned a lot during those formative years, including how to interact with clients and manage their expectations. My father also instilled in me the responsibilities of being a business owner and, most importantly, to always do the right thing for our clients.

I started this business in 2001 with Raymond James and renamed our wealth management team Banyan Wealth in 2020. Our team has a commitment to our clients that was founded on the understanding that you have three very important assets; the first being your health, the second your family and the third your financial assets. In retrospect, I learned these three important commitments from my father. I did not know it at the time, but he was my greatest teacher and, along my childhood journey, was imparting the very values in me that I bring to my own business every day.

To conclude, my father’s trucks always read “Why Call The Rest Call The Best.” He sure was.

S&P 500

The S&P 500, a market cap weighted index, ended the quarter up 16% as it has been exhibiting a relentless move higher. But is it all that it appears? As we end the quarter, we see that 10 large technology companies have contributed approximately 80% of the mover higher for the index, with thinner market participation appearing on the surface. The S&P 500 Equal Weighted Index was only up 6%. This is a large discrepancy between the two indexes that are comprised of the same individual companies. We will continue to monitor this to see if the divergence improves.

Source: FactSet

Inverted Yield Curves

Over 80% of the various points on the yield curve are now inverted. This is the largest percentage of the number yield curves being inverted in this interest rate tightening cycle. Going back to the 1980’s, there has been several instances in which a large percentage of the yield curves inverted prior to the S&P 500 trading to a new 52-week high. The result of the prior instances was a good size correction in the S&P 500. With the Federal Reserve appearing that they will raise interest rates again in July for the 11th time in this tightening cycle, it is hard to ignore the fact that such large percentages of inversions often lead to a recession. Below is the 3 Month Treasury Yield and the 10 Year Treasury Yield curve, which is inverted but off its inversion lows. The degree of the inversion is large.

Source: StockCharts.com

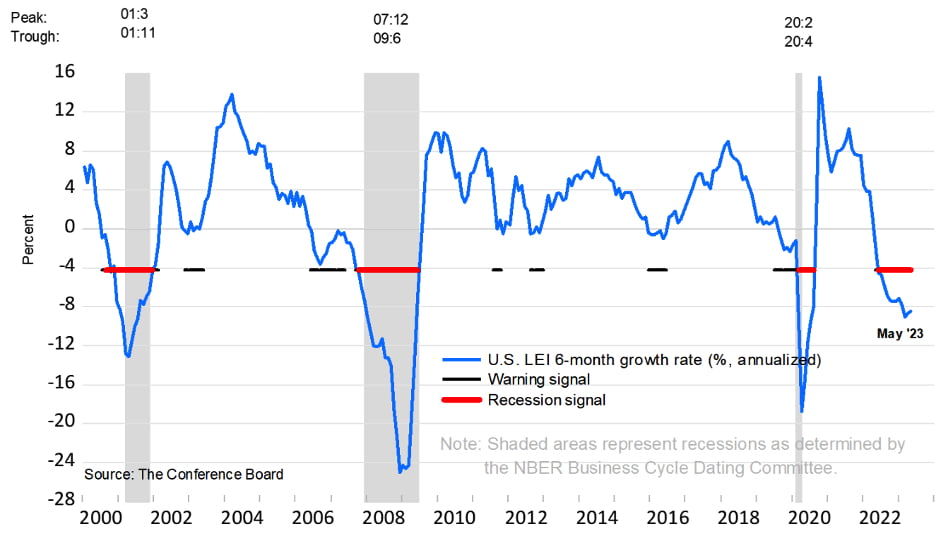

The Conference Board Leading Economic Index

The Conference Board Leading Economic Index (LEI) for the US recently released its May data. The data for this index has now fallen sequentially 14 months in a row. The implications of this continued weak data are signaling economic weakness and the possibility of a recession within the next 12 months.

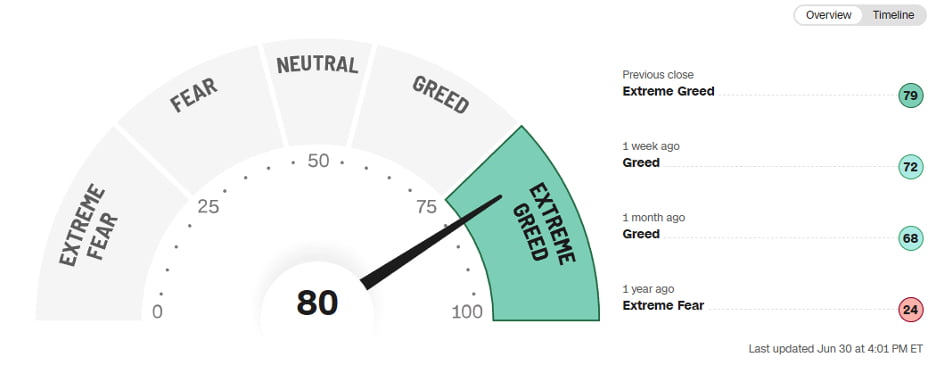

Fear Indicators

We believe the CBOE Volatility Index as well as the CNN Fear and Greed Index are both displaying complacency and do not reflect the possibility of economic weakness as being signaled by the LEI for the US. Nor do they represent the possibility of a pending recession that the yield curve inversions are implying. In the event there is economic weakness or a market event that initiates selling pressure, the decline could be rather quick and painful for equities and other asset classes.

Source: StockCharts.com

Source: CNN Fear and Greed Index

Summary

2023 has been an interesting year. As summarized above, we have seen a handful of companies dominate the performance in the S&P 500 Index. We see potential recessionary signals from various indicators increasing, yet have witnessed a few market sectors move meaningfully higher. We are fortunate to be overweight a few of those market sectors in most of our proprietary models. Nevertheless, we are cautious short-term and bullish intermediate to long-term. We are always intermediate to long-term focused and believe as investment advisors that we have a responsibility to manage the risks in our portfolios. Since we cannot control market performance, we can simply manage the risk associated with investing. We make every effort to balance the rewards of being right with the risks of being wrong, thus, we will from time-to-time adjust the weightings or even sell certain investments to accomplish this risk management. This does not make us market timers or change our intermediate or long-term belief that equity markets move higher over time; it is simply prudent risk management.