“The pessimism of 2023 was overstated; worrying dynamics had surprisingly more favorable outcomes – at least in the markets’ eyes. In 2024, we appear to have the opposite view: uber-optimism leaves the markets vulnerable to disappointment.”

– Lawrence V. Adams, lll, Chief Investment Officer, Raymond James

2023 was certainly an interesting year at a minimum. As I had written in the 2023 Third Quarter Insights and in the Second Quarter of 2020 Insights, monetary policy is a key driver of risk assets. As we witness in much of 2023 the position of the Federal Reserve was of tighter monetary policy and higher Interest rates for longer. This position had a direct effect on most risk assets for most of the year until we got half way through the fourth quarter. In the fourth quarter we saw inflation continue to wane and a softening of the Federal Reserve’s stance on short-term interest rates. The result, was an almost parabolic rise in risk assets in a very short time based upon the thought of the Federal Reserve reducing interest rates significantly in 2024, by some measures 7 quarter point cuts in 2024. Now that sounds awesome as an investor, but as we will discuss later, it might leave the markets vulnerable to disappointment.

Inflation

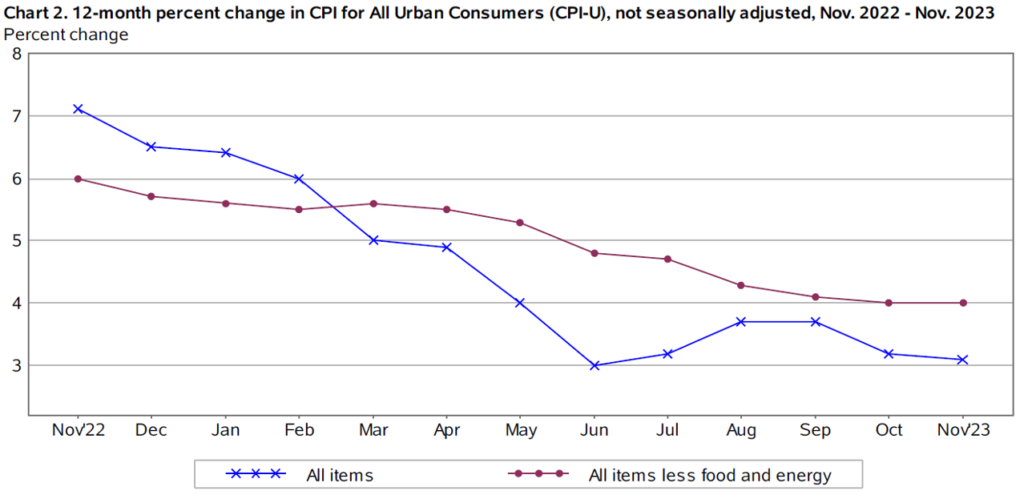

Inflationary data continued in a disinflationary direction in the fourth quarter with Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCE) both continuing cool from their 2022 highs. Energy prices including gasoline have declined during the fourth quarter. Inflation seems to have peaked and most likely will not be the big headline of 2024.

Source: U.S. Bureau of Labor Statistics

Leading Economic Indicators and the Yield Curve

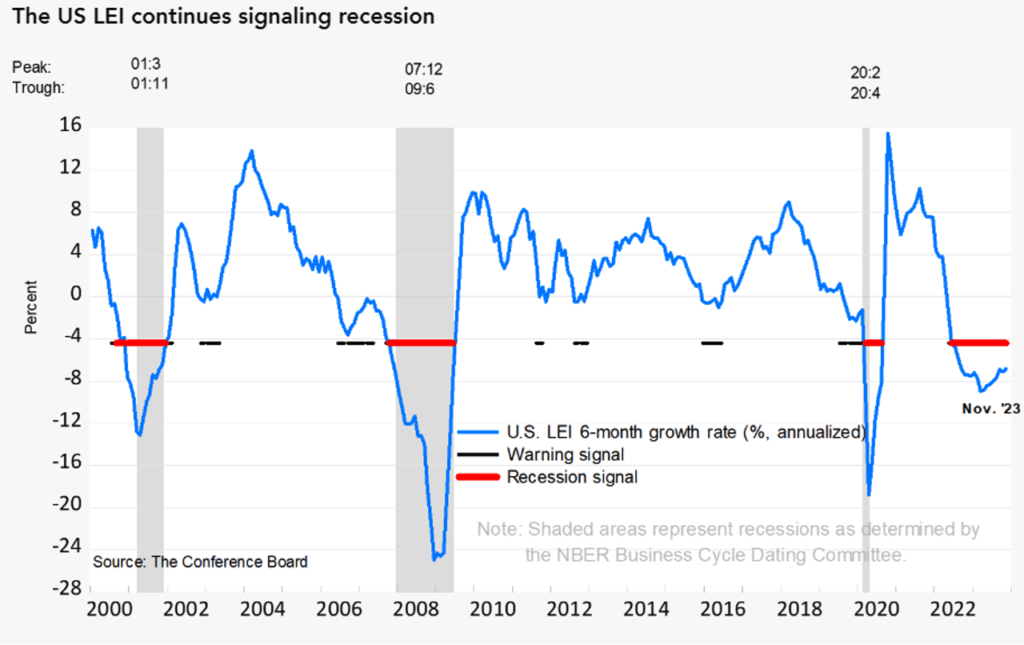

The Conference Boards Leading Economic Indicator Index (LEI) declined for a 20th consecutive month in December and continues signaling a recession. All prior streaks that have lasted longer than 12 months have resulted in a recession.

Source: The Conference Board

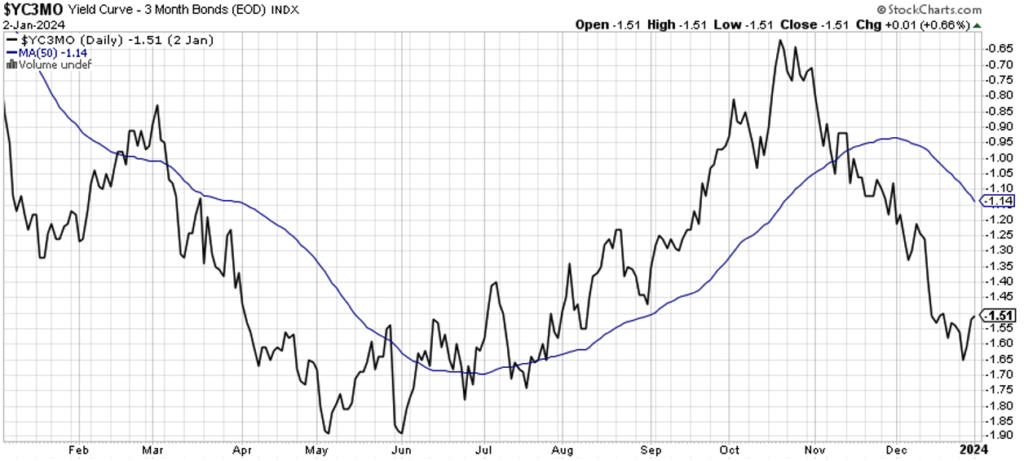

Below is an updated chart of the spread between the 3-month Treasury yield and the 10-year Treasury yield. When this yield curve inverts, it tends to be a reliable predictor of a recession. This yield curve inverted in October of 2022 and has an average 589-day lead time from date of inversion to the start of a recession.

Monetary Policy

Currently the Federal Funds Rate (target rate) is 5.25% to 5.50%. The markets are expecting a large number of cuts to this rate in 2024. Theoretically, lower rates are good for risk asset prices. But as history has shown that when/if the Federal Reserve were to get very aggressive with its interest rate policy and rapidly reduce rates, it is generally for the wrong reasons. Rapid reductions of the Federal Funds Rate often are made because the economy is headed for a recession or in a recession. The economy has weakened to merit such rapid rate cuts. Examples of this are 2001 and 2007. At this point, I do not believe this to be the case, I do believe that any recession would be minor and that the Federal Reserve will be guarded with their policy rate for the following reason. The fear of reigniting the inflation fire if they were to get aggressive when loosening monetary policy. A resurgence and reacceleration of inflation would be worse outcome for the Federal Reserve then a gradually slowing US economy or a mild recession.

Summary

Over the short-term we are maintaining our cautious view on risk assets but are bullish over the intermediate to long-term. We believe inflation peaked in 2023 along with interest rates and the Federal Reserve could possibly turn dovish in the second half of 2024. With potentially lower inflation and lower interest rates, this could set up for a more favorable investing environment for risk assets in the second half of 2024.