“Today’s a good day. Tomorrow will be better.”

– Nicholas Sergio

In many ways, the events of 2020 are both significantly different and identical to the Great Recession of 2008-2009. The major contrast is that the Great Recession was a structural event with massive wealth destruction, while the 2020 Pandemic was a transitory event leaving our economy and U.S. families with greater financial health and strength. On behalf of the entire Banyan Wealth team, thank you to all of our valued clients for the opportunity to play such an important role in your lives as we begin our return to normalcy. As we begin this transition, we hope you spend this time with your family and friends, catching up on those missed doctor’s appointments and simply returning to living the life you love.

COVID Recovery

One year ago, the S&P 500 had bottomed after the fastest 34% correction in its history. A year later and over 550,000 lives lost to Covid-19, we find ourselves on a fast track to recovery. Signaling a broad-based rebound in hiring, March non-farm payrolls rose by 916,000 and the unemployment rate dropped to 6%, down from a COVID high of 14.8% in April 2020. Household balance sheets are in great shape with net assets growing to $122.9 trillion from the end of 2019 pre-pandemic levels of $114 trillion. Low interest rates, an accommodative Federal Reserve and a big move from city life to the suburbs is also adding to the recovery in a big way. Factories around the world are struggling to keep up with demand, supply chains are strained as workers are being hired back, furloughed factories are reopening and the hardest hit industries (hospitality and leisure for instance) are hiring workers back at a strong pace. There will be some bumps in the recovery and it won’t be balanced for everyone. However, the combination of an accommodative Federal Reserve and President Biden’s pressing down of the accelerator pedal with his Covid Relief Bill – stimulus checks being deposited in people’s bank accounts and his proposed $2.0 trillion American Jobs Plan package – the recovery could move faster than most would have thought possible only 12 months ago.

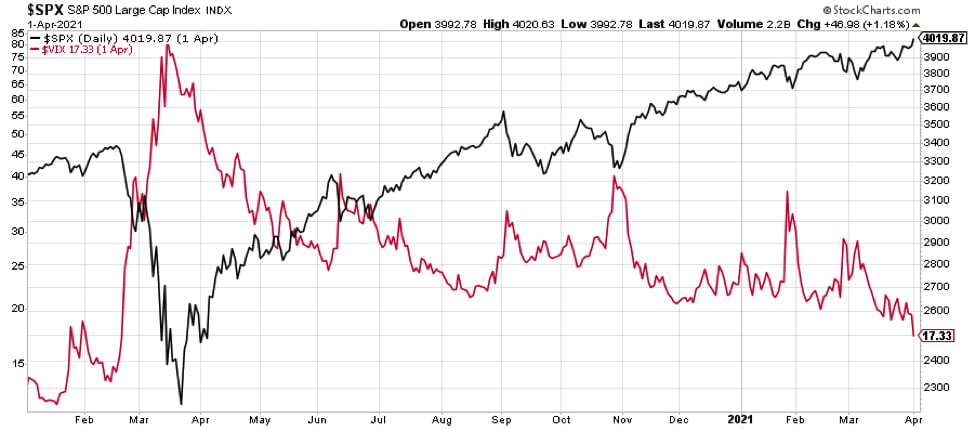

Periods of Increased Instability Create Periods of Stability

During the large shocks to the economy and financial markets in 2020, we saw the Volatility Index spike to an extreme high of 85. Those spikes corresponded with a 34% drop in the S&P 500. Since the bottom in March of 2020, we have seen the Volatility Index return to levels seen pre-pandemic and the S&P 500 tag all-time highs. Generally, a falling or low Volatility Index is beneficial for equity prices. In the chart below, the Volatility Index is red and the S&P 500 is black.

Source: StockCharts.com

Dow Theory Buy Signal

In January, we registered another Dow Theory Buy Signal with the Dow Jones Industrial Average hitting all-time highs concurrently with the Dow Jones Transportation Index also registering all-time highs. This is a healthy sign for higher prices in the intermediate to longer-term time frames.

Source: StockCharts.com

Interest Rates and Equity Prices

Recently, we have experienced a rise in interest rates, specifically in the 5, 7 and 10-year Treasuries. Investors in growth stocks seem to have been spooked by such an interest rate rise. There is investor speculation that the U.S. Economy is on the verge of rapid inflation and the Federal Reserve is going to be forced to raise interest rates sooner and faster than anticipated. Our view is that any short-term rise in inflation will be mostly transitory based upon the rapid reopening of our economy and the desire for Americans to return back to more normal lives. We will also note that slowly rising interest rates are not necessarily a bad thing for equity prices. During the 1992 – 2000 time frame, the Federal Reserve and Alan Greenspan raised interest rates and the S&P 500 rose nearly 300%.

In Closing

With the events that have occurred over the last 12 months, my opinion remains unchanged – the Secular Bull market will continue to roll on for many years as we are in a long-dated Secular Bull Market that was reset during 2020.

Be well, be safe and live the life you love.