“It’s Time to Turn the Page and Begin a New Chapter”

– Nicholas Sergio

To our valued clients and friends,

As we turn the page from a COVID-driven pandemic world to a post-COVID pandemic world, we would like to thank all of you for the opportunity to play such an important part in your lives. 2021 will no doubt will be a better place, providing all of us the opportunity to see friends, family, travel and, most importantly, live the lives we love.

In the case you may have missed the announcement, yesterday was a big milestone for our firm. As we turn the page on 2020, we are also turning the page and beginning a new and exciting chapter. After several months on self-exploration, analysis and discovery, we are thrilled to share a new name and corporate identity. While the project was planned prior to the pandemic, the past several months have only reinforced the importance of this change. In particular, our new tagline of “Live the Life You Love” has become more relevant than ever and, as some of you have may have noticed, been a personal mantra over the past several weeks. Most importantly, our rebranding was critical for our team to have a message and visual identity that was authentic to who we are as a company and reflects our unwavering commitment to you. It’s important to note that there are no operational changes related to this change and we will continue to remain a wealth management division under the Raymond James Red Bank office. Banyan Wealth is simply an external representation of the corporate culture, values and approach that you’ve come to expect and deserve from us since 2001. We encourage you visit https://banyanwealth.com/our-story to learn more about the story behind our transformation and view our new website experience. In the coming weeks, stay tuned as we’ll be introducing more exciting news and updates.

COVID Crash

It would be a huge understatement to say 2020 will be a memorable year for all. Looking back, the themes of this past year’s Quarterly Insights tells a remarkable story:

Second Quarter 2020 Insights: “Periods of Instability Create Stability”

Third Quarter 2020 Insights: “Event + Response = Outcome, It’s Your Choice”

Fourth Quarter 2020 Insights: “It’s not about how much money you make, it’s about the decisions you make with it that makes the difference.”

2020 was a year in which we saw global economies shut down, unprecedented government monetary and fiscal policies and large price swings in financial markets. The size of these swings was greater than any of us had ever seen; larger and more powerful than swings we experienced during the height of the Great Recession. During late March, the S&P 500 was making swings of 5%+ on a daily basis. The sheer magnitude of negative news and volatility in the financial markets shook most investors to their knees.

We always begin each of our quarterly insights with our four disciplines of investing as they have survived the test of time and are especially critical during challenging times. Three of which have had important relevance over the past several months:

“Investing is a marathon and not a sprint.”

“Knowledge creates success; stay calm, objective and long-term oriented.”

“Choose carefully what you read and to whom you listen.”

These disciplines guided client decisions in 2020 and were more critical than ever. At one moment in March, the S&P 500 was down over 30% and the world seemed to be ending based upon media reports. By August, the S&P 500 had recovered all of its losses and went on to finish the year at an all-time high. Events like we have all experienced this year are truly tragic, but often a transitory shock to the system and not a structural event. With vaccinations underway, the economy will recover and things will slowly return to normal.

Recession Fears

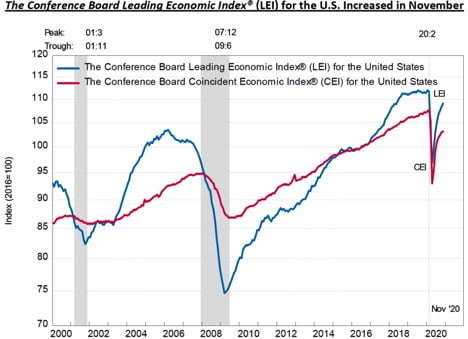

The Conference Board Leading Economic Index (LEI) for the U.S. has made a sharp rebound off its March 2020 lows. This is a good indicator of the strength and direction of the economic recovery moving forward. With an accommodative Federal Reserve and low interest rates, it appears the U.S. is looking to exit from its current recession. If the case, this could be one of our nation’s shortest recorded recessions.

Source: The Conference Board

Index Highs and Monetary Policy

With the Federal Reserve maintaining a 0% short-term rate policy and trillions of stimulus and support dollars being poured into the economy, we have seen an explosion in growth of money supply into the U.S. economy. This money supply is very stimulative to our nation’s growth as well as economic activity and has a tendency to drive risk assets higher. With the Federal Reserve sitting near 0%, combined with an accommodative economic policy and willingness to let Inflation run hotter and longer to achieve a broad-based and sustainable economic recovery, we have seen risk assets move higher accompanied by strong advanced/decline lines moving to all-time highs as well. All three Indexes below are hitting all-time highs in a COVID world.

In Closing

As I have previously penciled many times before, it is my opinion that we are in a secular bull market with years to run. In my 2020 First Quarter Insights, I wrote that we could see the occasional correction of 10%, 20% or more. Who would have thought at the time we would experience in the months to follow a once-in-a-lifetime pandemic? But needless to say, we did, and the Federal Reserve acted brilliantly with speed, support and stimulus. The end result of their actions is one of the fastest economic recoveries we’ve experienced in history, combined with a technology revolution that is driving growth and digitization into the cloud at a pace that is truly awesome. We have witnessed critical breakthroughs in technology that allowed the world economies to continue and prosper during a very difficult period in our lives. It’s this same technological revolution fueling the development of a vaccine that will change our lives for the better in a speed that 10, 15 or 20 years ago would have seemed impossible. It’s through these very innovations and technology achievements that drive great secular bull markets.