“Event + Response = Outcome

It’s your choice.”

The relevance of the above is more appropriate than ever. If it sounds familiar, it’s likely because you’ve noticed it proudly displayed in my office. During these unique times, this quote means everything. Reflecting on the past four months, I think about all those affected by this horrible pandemic as it’s been such a challenging period for everyone, especially those in our surrounding New Jersey and New York counties. I wanted to take this opportunity to provide an update on the firm and how my team and I have been managing through this extraordinary period. While our home state of New Jersey has suffered the second most cases and unfortunate deaths from COVID-19, we remained open throughout. The team has worked tirelessly, including 13-hour days with JR and myself logging six days a week for seven consecutive weeks. Dawne’s husband contracted COVID-19 but it didn’t prevent her from missing a single day as she worked remotely while caring for him and her family. Trish continued to do an awesome job, similarly not missing a day of work despite the uncertainty and circumstances. I mention this not to elevate ourselves as we reserve this for the heroes on the front lines of this pandemic who are sacrificing so much for all of us. I simply state this to reinforce the commitment we have for each of you – our clients, friends, families and advisors. As a team, this commitment is founded on the understanding that you have three very important assets; the first being your health, the second your family and the third your financial assets. We thank you for the opportunity to play an important role in your life and the trust you instill in us on an everyday basis. For this, we are humbled and truly grateful. We live in a great country with the best and most resilient economy in the world. As history tells us, America will heal, recover and become a stronger nation as a result of these times.

Three Keys to Fighting a Global Pandemic: Speed, Stimulus and Support

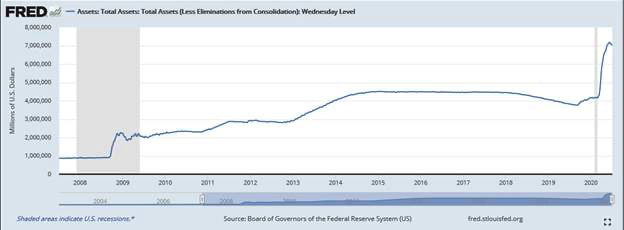

When I addressed this topic in my Second Quarter Insights, we were in the midst of a financial meltdown and I couldn’t have been more serious about the actions that were needed. The S&P 500 had just undergone a 33% correction in 33 days while the world economies had basically stopped. As I described in my Second Quarter Insights, the Fed acted swiftly by launching a massive bazooka of fiscal and monetary stimulus at the economy. The result of the stimulus is one of the shortest bear markets in history as well as one of the strongest starts to a bull market – yes, I said bull market – since the Great Depression. Below is a chart demonstrating how rapidly and massively the Federal Reserve increased their balance sheet and flooded the U.S. economy with much needed stimulus and support.

Source: Federal Reserve Bank of St. Louis

During periods of high stress in the financial markets, the fear and stress will be in full display in the Bank of America High Yield Option Adjusted Spread. I know what you’re thinking but bear with me for a second. For the below chart, I ask that you focus on the big spike that occurred late in the first quarter. In layman’s terms, this index represents fear of defaults in the nearly one and a half trillion-dollar high yield bond markets. When this index trends higher, it’s not a good indicator for equity markets, fixed income markets as well as the U.S. economy. Please note how quickly this index retreated from elevated levels as the Federal Reserve and U.S. Treasury provided stimulus and support in massive size.

Source: Federal Reserve Bank of St. Louis

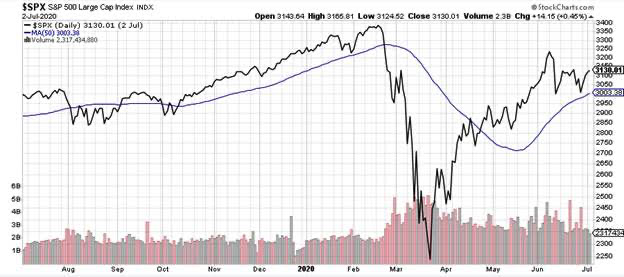

How did the S&P 500 react to the unprecedented actions by the Federal Reserve and U.S. Treasury? Below is the chart of the S&P 500 and its rapid drop, followed by its massive rally off the lows that corresponded with the monumental actions of the Federal Reserve and U.S. Treasury.

Source: StockCharts.Com

Investor Sentiment and the Volatility Index

Despite the gradual reopening of the U.S. economy, stronger employment numbers over the last several weeks (although from much elevated numbers) and a rebounding of stocks and fixed income markets, the AAII Investor Sentiment Survey reported the average investor saw less than 25% of all respondents bullish on equity markets for the last three weeks. Not only are investors not overly bullish (a positive indicator), there is a whopping $4.7 trillion dollars reserved on the sidelines parked in almost 0% interest rate money markets as investors wrestle with why the markets are higher.

Volatility still remains high as displayed in the below elevated Volatility Index (VIX). Until this indicator returns to below 20, preferably 15 or lower, the markets can be subject to greater moves in price. The VIX indicator appears to be moving in the right direction.

Source: StockCharts.Com

In Closing

Americans are resilient and the greatest melting pot of people to ever live under one flag united together. During the first half of 2020, there have been many challenges. I do not expect the equity markets to have a continued linear accent since we have a massive recovery to achieve. What I do firmly believe is that bear markets end in despondency and bull markets are created on hope. With the Federal Reserve continuing to implement their various tools in large size to help the nation persevere through this health crisis – and we will get through this – I will gladly use this as an opportunity to continue to invest in what appears to be the fourth Industrial Revolution.

As always, please don’t hesitate to reach out to the office if you have any questions. On behalf of our entire team, we wish you and your family health and happiness through these unique times.