“In my view, the biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. Not only is the mere drop in stock prices not risk, but it is an opportunity. Where else do you look for cheap stocks?”

– Li Lu, Himalayan Capital

The Delta Variant, Inflation, Interest Rates and Debt Ceiling (OMG!)

The third quarter was full of anxiety for the average investor with lots of chatter on the Delta Variant, inflation, interest rates, the Federal Reserve discussions about tapering some of its much-needed COVID-19 economic stimulus and so much more. The Delta Variant has been more disruptive than originally thought and responsible for most of the supply chain disruptions and recent finished goods production deficiencies. Unfortunately, when factories shut down, countries lockdown and businesses are forced to close, this creates temporary or transitory effects on the price of goods driving costs higher for us consumers. This transitory inflation should start to abate as herd immunity continues, the vaccinated population grows and hopeful approvals of other simpler therapeutics are introduced in the market, like Merck’s new experimental COVID-19 drug treatment. In a clinical trial, Merck’s new oral therapeutic reduced hospitalizations and deaths by half of those recently affected. Imagine the Tamiflu for COVID-19, a simple pill that would help control future waves of the virus. These types of therapies, combined with the effectiveness of vaccinations, are providing hope today and will have a dramatic effect on supply chains, factory production and the cost of goods across the world.

Inflation normally leads to higher interest rates, thus a slowdown in inflation could result in interest rates rising at a much more gradual and controlled rate. Moderate inflation, which should help boost consumer demand during a slowly rising rate environment, often is not a negative for equity markets. During the period from December 2015 through December 2018, the Federal Reserve raised interest rates nine times and the S&P 500 rose by nearly 40%. Lastly, the debt ceiling, infrastructure bill, reconciliation are concerns since our government officials tend to behave like a dysfunctional family but they often get the people’s business accomplished in a very unorthodox manner. Let politicians be politicians and don’t get caught up with the constant media coverage – change the channel.

Volatility

During the recent 5% pullback in the S&P 500, the Volatility Index has traded in a very orderly fashion and not broken above highs seen during last October’s correction in the S&P 500.

Source: StockCharts.com

S&P 500

The S&P 500 is showing signs of consolidation after a 15% YTD return in 2021 and 16% return in 2020.

Source: StockCharts.com

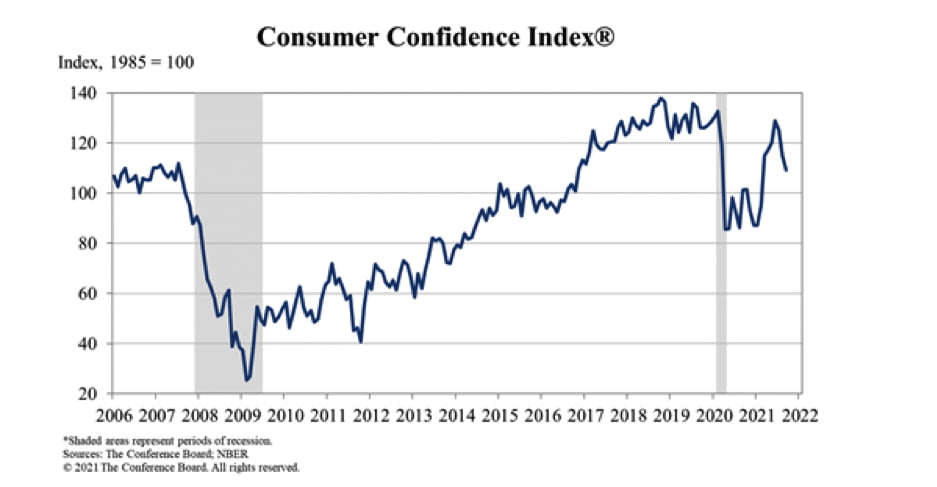

The Consumer

The consumer is in a very good position as we come through what hopefully is the back-end of COVID-19. Consumer mortgage lending is low relative to asset value, unlike the early 2000s when mortgage lending to asset values was breaking out to new extreme highs. Consumer credit is rising but not at a rapid pace and the consumer is flush with cash after deleveraging their balance sheet during the COVID-19 crisis. Though we have seen consumer confidence sentiment recently weaken with the spread of the Delta Variant, the consumer’s elevated view of inflation is showing signs of easing. However, it’s more likely that we’ll see a more cautious consumer in the short term until we see some of the headwinds subside.

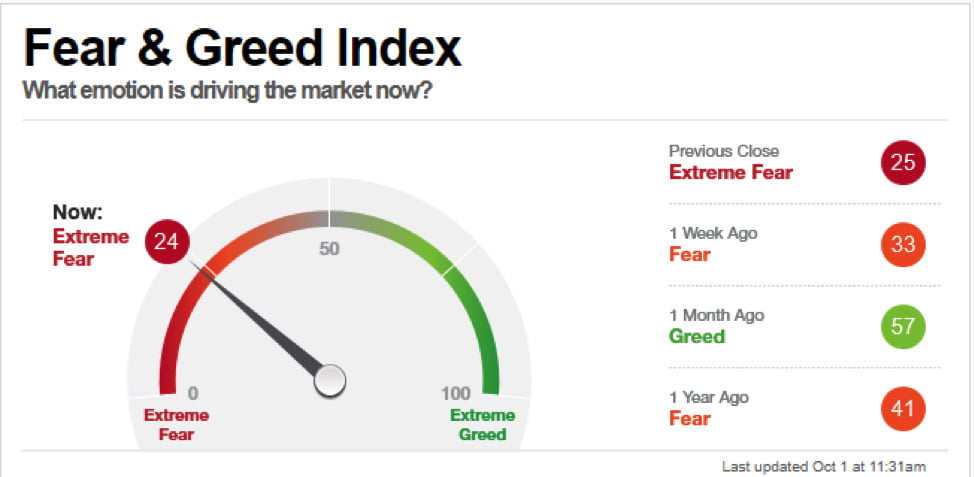

The CNN Fear and Greed Index

The CNN Fear & Greed Index is an index that uses seven indicators: stock price momentum; stock price strength; stock price breadth; put and call options; junk bond demand; market volatility; and safe haven demand. Now that I have bored you with the details, this index recently has been exhibiting extreme fear readings of 24. During the month of August, it registered signs of greed at 57 on the scale. I remind you that at all-time highs in the markets, the average investor was greedy and, after a nearly 5% fall for the S&P 500, the average investor is now fearful. Investing is not a sprint but a marathon. To be truly successful at long-term investing, the investor needs to filter out the noise of short-term fluctuations and focus on the larger picture.

Source: CNN Money

Secular Bull Market

As I often have written, I believe we are in the midst of a large secular bull market similar to the 1982 – 2000 bull market that was interrupted by a 30% crash in October 1987. I believe COVID-19 was our 30% crash. Through the unprecedented Federal Reserve stimulus, the massive amounts of liquidity injected into our system should have a positive long-term effect on asset prices, in particular risk assets. The American consumer came through this period in much better financial condition than pre-COVID-19 with US household net worth increasing by $5.8 trillion dollars to a record of $142 trillion dollars in the month of June. The consumer is healthy and willing to spend, interest rates are low and inflation looks to be peaking as COVID-19 cases are rolling over. The combination of these three elements places us in a very good long-term position as investors. Corporate profits are also at record highs, reinforcing the strength of the American consumer as well as our economy. Yes, there will be corrections, scares, negative headlines and whatever else the media can muster up to distract investors. Stay the course, stay invested and stay long-term focused.