“Part of the wage increase that is really powerful is that you are starting to create some real benefits around the wage gap.”

Rick Rieder, Blackrock CIO, Global Fixed Income, February 9, 2022

As I sit in my Red Bank office this cold, wet and rainy first Sunday of April, I’ve found myself reflecting on what a challenging first quarter it has been to be an investor. First off, I would like to express our thoughts and prayers for the people of Ukraine. During the first quarter, we have seen an investing environment that has become significantly less certain and more volatile. We have experienced a war between Russia and Ukraine that has created global uncertainty in so many aspects, most notably the result of higher Inflation and the ripple effect of sanctions throughout the global economy. The impact of the war was similar to pouring jet fuel on top of a small fire called Inflation. We have seen oil, natural gas, wheat, palladium and nickel prices soar, creating significant inflation in these markets and certain supply disruptions in the same commodities. We have seen U.S Bonds have the worst quarter in over 40 years with yields soaring and bond prices dropping, resulting in the Bloomberg Aggregate Index to post a negative 6% for the quarter while the longer dated treasuries lost over 10% during the quarter. Equities did not fare much better; after nearly a 13% drop for the S&P 500, all the major equity averages closed the quarter in the red. As for the additional negative events that have influenced the financial markets over the past quarter, we have experienced a yield curve inversion, talks of a recession, soaring borrowing rates and a significant drop in mortgage applications.

With all that being said, I would like to remind all that market bottoms are a function of price and time and that markets do not bottom on good news – they tend to carve out bottoms when the news flow seems like it can’t get any worse.

Interest Rates – Mortgage Rates – Housing

With the Federal Reserve initiating the first interest rate hike to the Federal Funds Rates in March (which was highly telegraphed in advance), the markets appear to be doing Chairman Powell’s lifting. Mortgage rates are one example of how the private sector is doing the work of the Federal Reserve. They have moved up from 3.22% in January to nearly 4.75% on a 30-year mortgage fixed mortgage – levels not seen since 2018. This increase is the private markets moving in anticipation of future rate hikes and will most likely result in a slowdown in home price acceleration, the refinance market, new home purchases and other related housing markets. Ultimately, the collective impact should curtail some inflationary pressures in housing as well as in the durables goods sector.

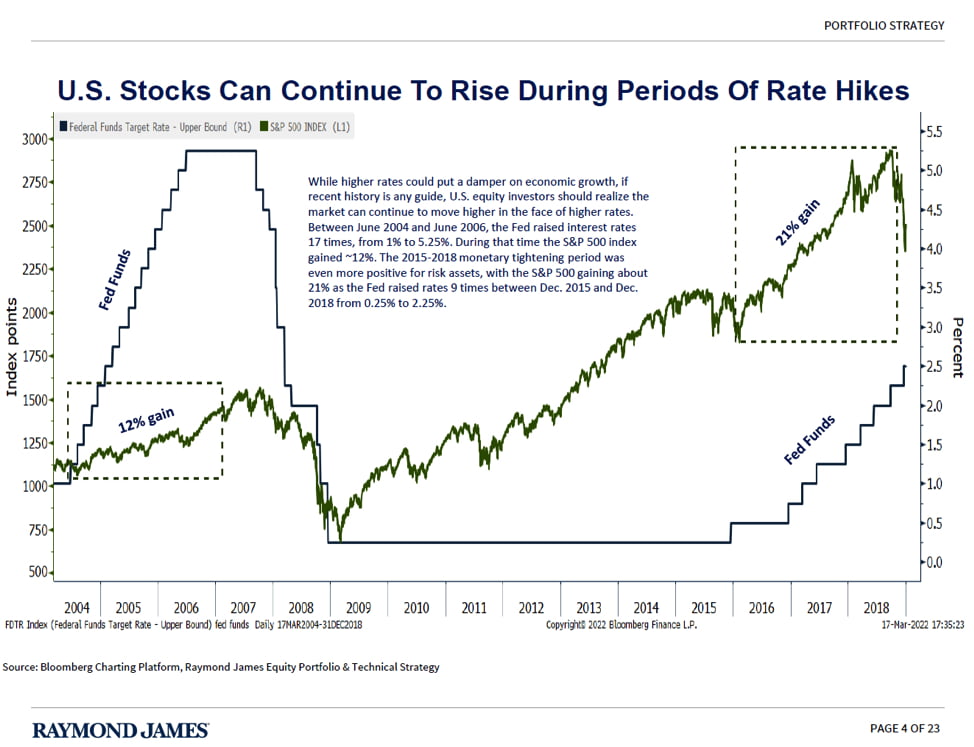

As shown below from our Raymond James Research Group, equity markets generally remain positive to the upside during periods of rising Federal Fund Rates.

Source: Raymond James

To follow up on this point, equity markets generally move to the upside during periods of slowly rising interest rate periods and strong economic conditions, as opposed to the exogenous events of war and sanctions which create a great acceleration in short-term inflation and massive supply chain interruptions.

Yield Curve Inversion

During the first quarter, we experienced a yield curve inversion of the 2-year Treasury yield and the ten-year Treasury yield. It is important to note there have been 10 inversions of this yield curve since 1976 and only 6 recessions. While this is something that needs to be watched closely, we believe Chairman Powell is more focused on the spread between the 3-month Treasury yield and the 10-year Treasury yield which has not inverted.

Source: StockCharts.com

Source: StockCharts.com

Oil

This week, President Biden announced that over the next six months he would be releasing one million barrels a day (180 million barrels in total) from the Strategic Petroleum Reserve (SPR). This coincides with some demand destruction occurring, most notably in Europe, as a result of elevated energy prices. This release from the SPR should help to alleviate some of the short-term supply issues surrounding crude oil and hopefully provide some modestly lower prices for consumers at the pump.

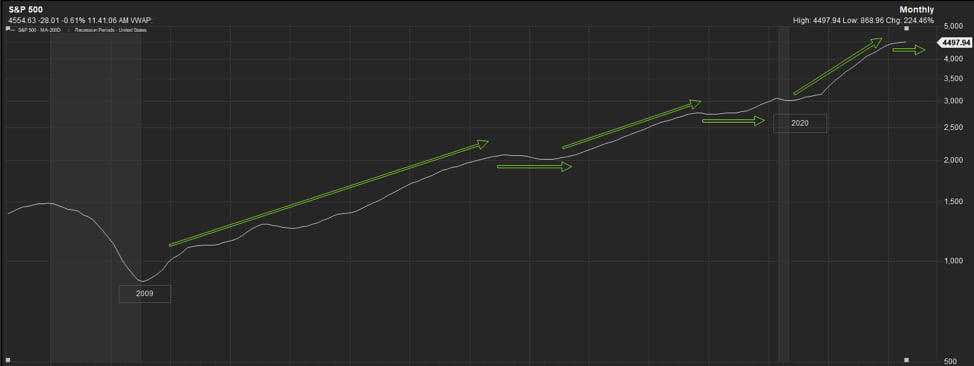

Secular Bull Market

Secular Bull markets often have cyclical bear markets embedded within them. The opposite is true of the period from 2000 through 2013. During this span, we had strong cyclical bull market rallies in a very large secular bear market where we experienced one of the largest bear market corrections during the Great Financial Crisis. As demonstrated in the chart below, the 200-day average for the S&P 500 can often depict the health of the markets during very noisy periods. The noisy environment that we are currently experiencing could very well be another consolidation period for the S&P 500.

Source: FactSet