“We have always lived in an uncertain world. What is certain is that the United States will go forward over time.”

– Warren Buffett

Welcome to 2023 and good-bye 2022. To say 2022 was a challenging year for investors would be an understatement. The NASDAQ lost 33%, the S&P 500 lost 20% and it was only the third time since 1929 that bonds did not go up when equities went down. It has been a year in which the most seasoned investors were humbled. I often say that periods of instability create periods of stability and I believe that once inflation is under control and monetary policy (which drives risk assets) becomes less aggressive or restrictive, the economy and markets will resume their growth and reward investors for their patience.

S&P 500 – Are We at the Bottom? It’s Too Early to Call

I recently used this chart in our most recent webinar and thought I would follow up on it. The S&P 500 has been attempting to stabilize after the cumulative raise of 425 basis points (4.25%) to the Federal Funds Rate in 2022. The Federal Reserve commenced its fight against inflation in March when they initiated their first rate hike and began one of the most aggressive rate tightening rate campaigns in history. As seen below, the index has been under pressure and is currently in a downward trend.

Source: FactSet

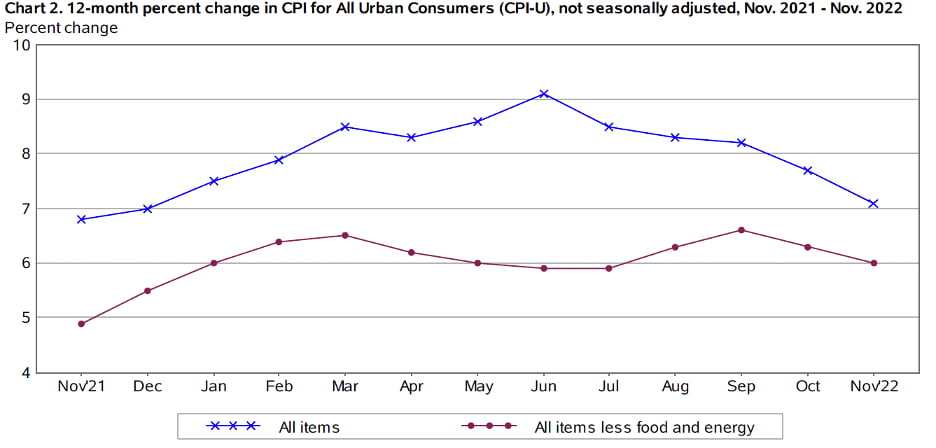

Inflation and the Consumer Price Index (CPI)

The November CPI report showed that inflation fell 7.10% year-over-year to the lowest level since December 2021 and Core CPI (ex-food and energy) fell to 6.00% year-over-year. Energy prices, durable goods and used cars were some of the components that cooled in the report. Overall, it appears that CPI is rolling over as we are just starting to feel the effects of tighter monetary policy.

Source: U.S. Bureau of Labor and Statistics

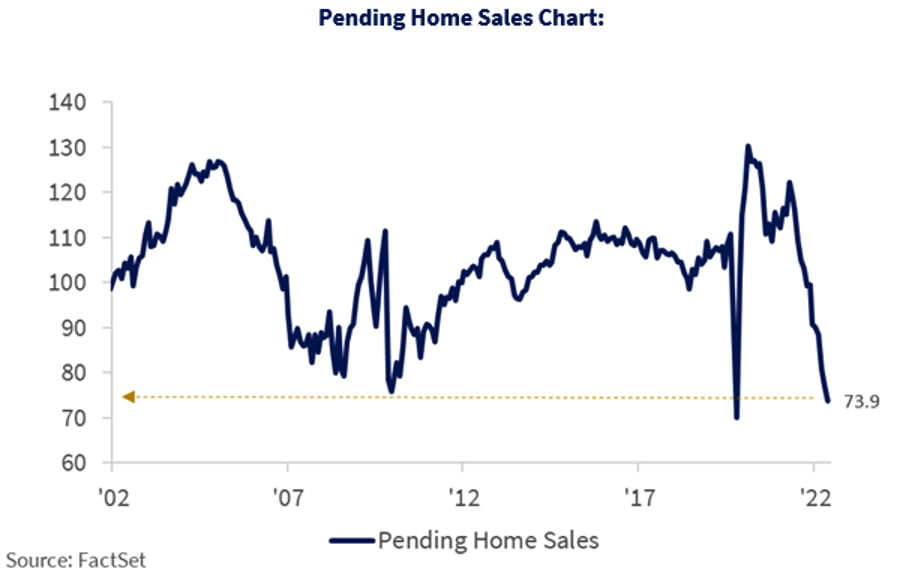

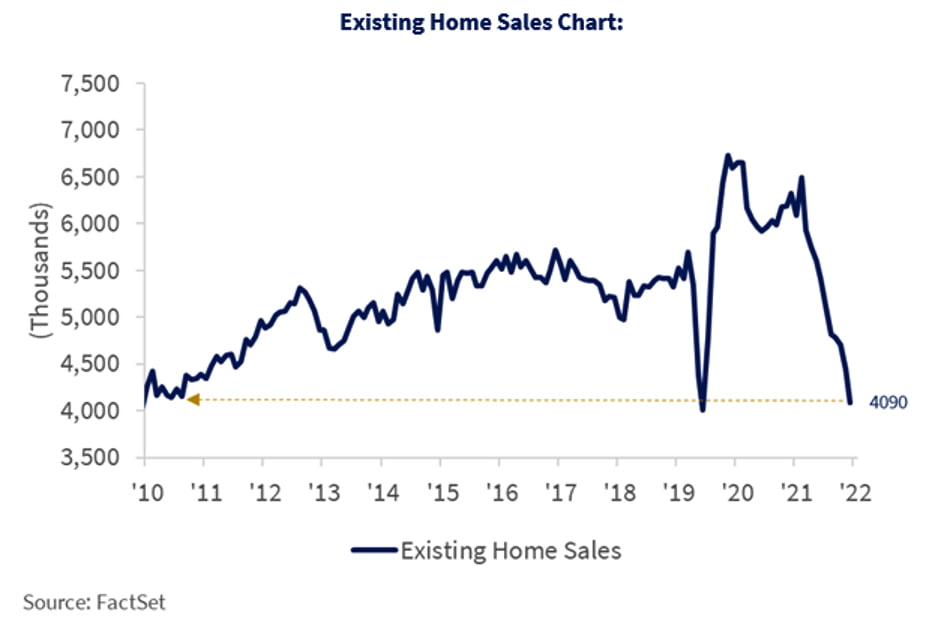

Home Sales – Continued Weakness

Pending home sales fell for the sixth consecutive month in November and existing home sales continued their weakness falling for the tenth consecutive month in November. Higher mortgage rates, inflation and a slowing US economy are starting to cool down this once hot market, representing another set of positive indicators demonstrating a potential trend towards lower inflation.

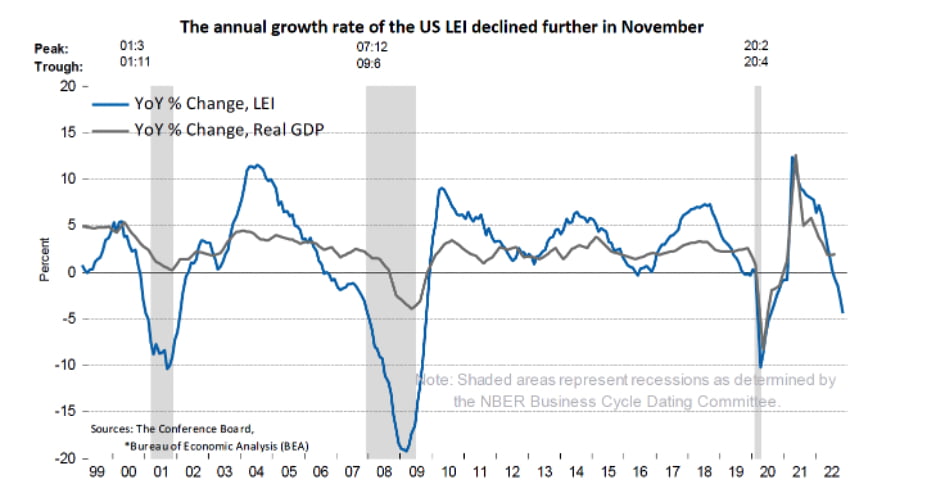

Economic Indicators – Recession?

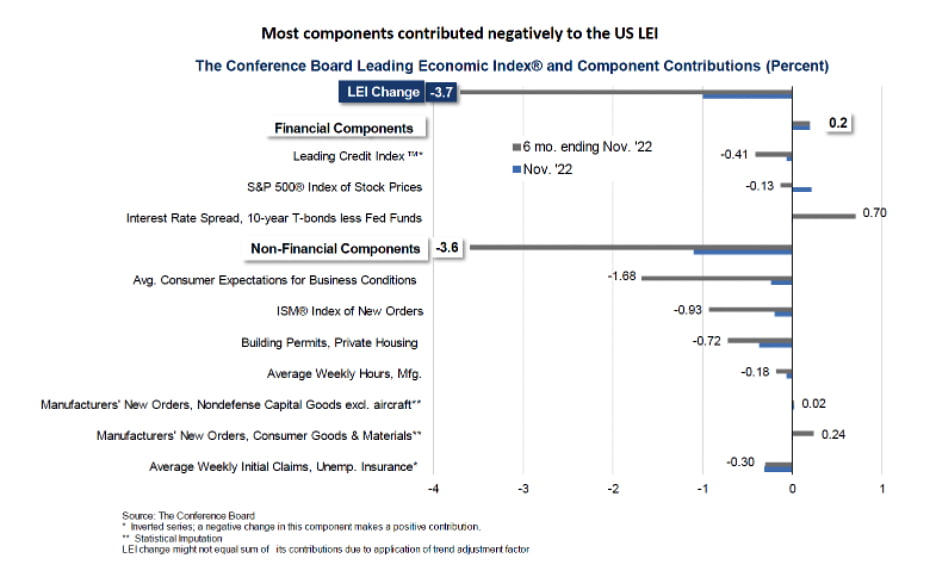

The Conference Board Leading Economic Indicator Index (LEI) decreased in November and is now down over 3.70% over the past six months. This steep contraction is indicating that despite tight labor conditions, the US economy is slowing down and heading in a trajectory that might imply an approaching recession.

To further demonstrate, most components are contributed negatively to the LEI Index in November as well as the prior six months. This reinforces that the Federal Reserve is slowing down the economy and cements Powell’s willingness to move monetary policy to more restrictive levels to stomp out inflation. His weapon of choice is the use of higher interest rates through the Federal Funds Rate.

Labor Markets – Out of Balance

While inflation indicators appear to be rolling over and waning, the Federal Reserve would like to see unemployment grow higher. Yes, I said the Federal Reserve wants more people unemployed. Higher unemployment will restore the balance of power back to the employer and help achieve a lowering of wage inflation. The Federal Reserve is attempting to create slack in the labor force so that it can slow wage growth and tame the inflation that is associated with higher wages. A slowing economy through more restrictive monetary policy is how they feel the task can be accomplished. In the case of unemployment, bad news (more unemployed) is good news for the markets and economy.