2022 First Quarter Insights

The 4 Rules of Investing

1. “Investing is a marathon and not a sprint.”

2. “Do no harm.”

3. “Knowledge creates success; stay calm, objective and long-term oriented.”

4. “Choose carefully what you read and to whom you listen.”

“Do not invest blindly, but invest with knowledge, experience and confidence. Only then will you be successful.”

– Nicholas Sergio

Happy New Year to all. 2021 is officially in the record books and, to most investors’ surprise, it turned out to be a good year. As we reflect on the past 18 months, we all have a lot to be thankful for. We have an economy on strong footing, low unemployment, minimum wages rising (that’s a very good thing) and a country that likely will be moving from a pandemic stage to endemic stage. As I sit and pencil this Quarterly Insights installment, my primary goal as always, is to help educate our investors and provide insights about the current investing landscape and where I believe it’s very likely heading. Unlike typical business news commentary, we do not intend to create anxiety for our clients but rather give them a sense of understanding of their investments, and be a reliable source of knowledge through both the good and challenging times. On behalf of the entire Banyan Wealth team, thank you for dedicating time out of your busy lives to read and listen to our advice - we are truly grateful. Each and every day, we appreciate the opportunity to play such an important part of your life and never take it for granted.

Periods of Instability Create Periods of Stability; Periods of Stability Often Create Periods of Instability

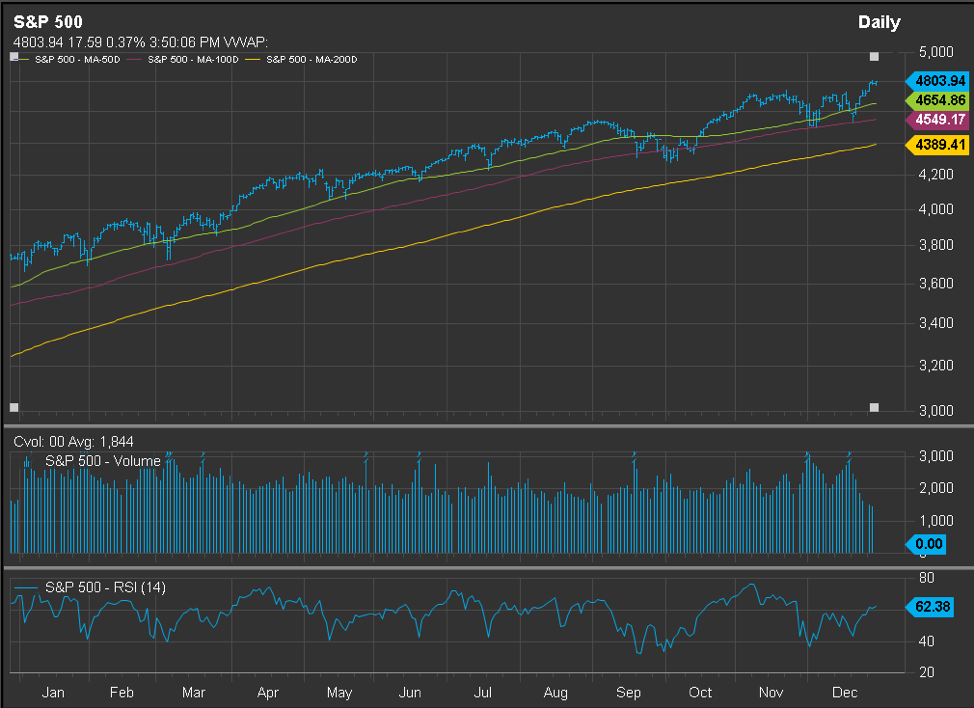

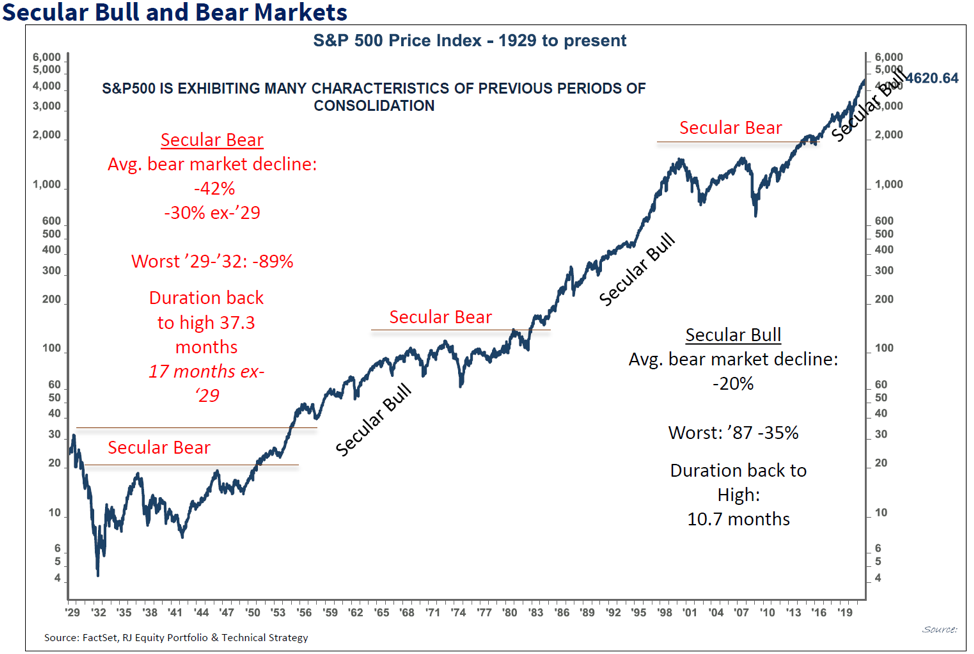

As we wrote in April of 2020, periods of instability often lead to periods of stability. This was especially true in 2021 with the S&P 500 having experienced no more than a 6% peak to trough drawdown as compared to an average secular bull market drawdown of 8% to 12%.

Source: FactSet

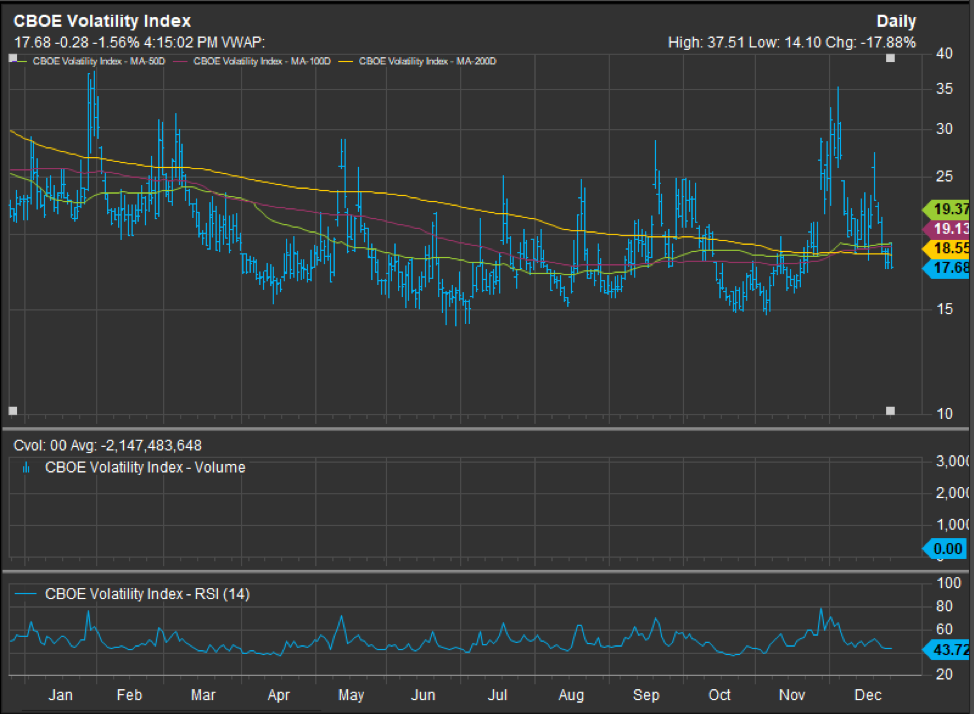

I would anticipate the investors’ honeymoon with stability to start showing some fracturing as we head into and through 2022. The Volatility Index (commonly referred to as the VIX) started to display some manic behavior in 2021 with multiple spikes up and down, this type of behavior in the VIX can often lead to larger, more typical drawdowns in the equity markets. Basically, with a pending tightening cycle to begin most likely in the first half of 2022, it is easy to assume that we will see a greater degree of volatility and price fluctuations in equity markets in the first several quarters of 2022.

Source: FactSet

Negative Real Interest Rates

Negative real interest rates are the federal funds rate less core inflation and by definition mean that inflation is higher than interest rates. As a result, savers will see a fall in the real value of their savings. When this rate is negative, which it is currently, their tends to be a positive correlation with the positive equity markets.

Bank of America High Yield Option Adjusted Spread

This index, which basically measures the perceived risk of default in the high yield bond market, recently traded to new lows in spread. These are pre-pandemic lows and reinforce that the outlook for corporate credit is strong.

The Economy and Recession 2022

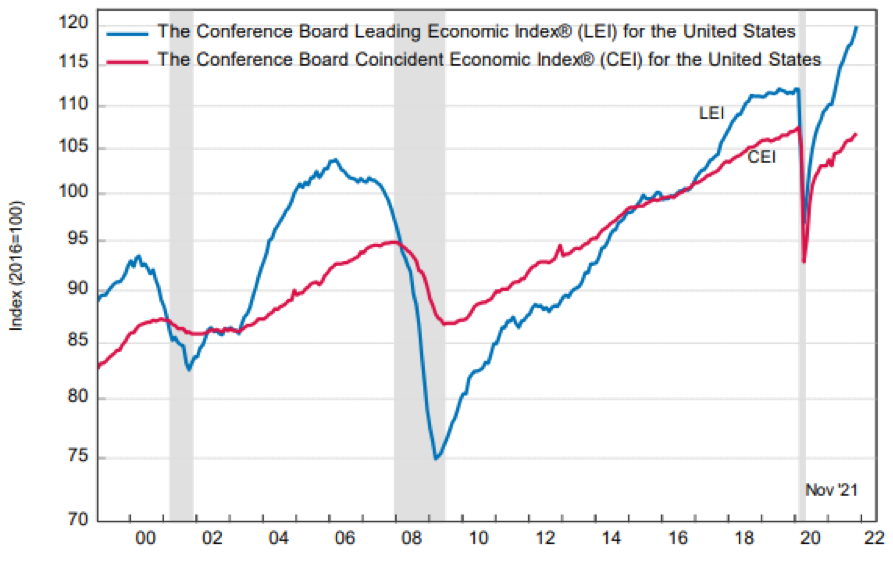

The Conference Board Leading Economic Index (LEI) and Coincident Economic Index (CEI) both hit new cycle highs in the month on November. These new highs are a sign that the US economy is healthy despite all the inflation fears that are currently present.

Source: The Conference Board

Secular Bull Market

In closing, we believe the secular bull market still has years to run and should reward those with patience and a longer-term investment horizon. In the upcoming year, we feel confident that the Federal Reserve will begin a tightening cycle by raising short-term interest rates. This higher initial interest rate move has a tendency to create a short-term negative reaction in the equity markets. However, in the longer term and as history has shown, the equity markets tend to react positively to this tightening cycle. With this being said, I would anticipate a short-term increase in market volatility and price fluctuations.

Written by: Nicholas W. Sergio, AIF®

Founder & Chief Investment Officer • Banyan Wealth

Registered Principal & Financial Advisor • RJFS

2022 RJFS Leaders Council Member*

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system. Dow Jones Industrial Average (DJIA) commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. The Russell 2000 Index measures the performance of the 2000 smallest companies in the Russel 3000 Index, which represents approximately 8% of the total market capitalization of the Russel 3000 Index. BPS stands for Basis Points and refers to a common unity of measure for interest rates, one basis point is equal to 1/100th of 1% or 0.01% it is used to denote the percentage change in a financial instrument. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of capital might occur. All investing involves risk and you may incur a profit or loss of capital. There is no assurance any investment strategy will be successful. All information, data and analysis provided in this report is for informational purposes only and is not a recommendation to buy or sell any security. This report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete; it is not a statement of all available data necessary for making an investment decision and it does not constitute a recommendation. Any opinions are those of Nicholas Sergio and not necessarily those of Raymond James and are subject to change without notice. Raymond James does not offer tax advice and services. You should discuss any tax matters with the appropriate professional. Holding investments for the long term does not insure a profitable outcome. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Forward looking data is subject to change at any time and there is no assurance that projections will be realized. High-yield bonds are not suitable for all investors. The risk of default may increase due to changes in the issuer’s credit quality. Price changes may occur due to changes in interest rates and the liquidity of the bond. When appropriate, these bonds should only comprise a modest portion of a portfolio. Investment advisory services offered through Raymond James Financial Services Advisors, Inc.

* Membership is based on prior fiscal year production. Re-qualification is required annually. The ranking may not be representative of any one client’s experience, is not an endorsement, and is not indicative of advisor’s future performance. No fee is paid in exchange for this award/rating.

https://www.conference-board.org/pdf_free/press/US%20LEI%20PRESS%20RELEASE%20-%20December%202021.pdf

https://www.usinflationcalculator.com/inflation/united-states-core-inflation-rates/