$40 trillion

That’s the staggering amount of wealth that U.S. women are expected to inherit or accumulate over the next 25 years, according to a report by Cerulli Associates.

In honor of International Women’s Day on March 8th, we celebrate women’s advancements in wealth and investing while discussing what lies ahead.

The Great Wealth Transfer & Women’s Growing Influence

Baby boomers (born between 1928 and 1964) and older generations currently control approximately $100 trillion of the roughly $124 trillion pile that is likely to soon be transferred to heirs. This handover has the potential to reshape industries and redefine investment trends- especially as women take a more active role in managing and investing their financial assets.

This so-called “Great Wealth Transfer” marks the beginning of a new era in wealth and investing. Women’s financial influence is expanding, fueled by economic and social progress. More women than men are enrolling in college, and female workforce participation continues to rise. In leadership, women now hold 29% of C-suite positions—up from just 17% a decade ago—demonstrating a growing impact on the economy.

Women and Investing: A Changing Landscape

Women’s presence in investing is also gaining momentum. In 2024, 71% of women had investments in the stock market—an 11% increase from the previous year. Gen Z women, in particular, are leading the charge, with 77% owning stocks.

Source: Fidelity Investments

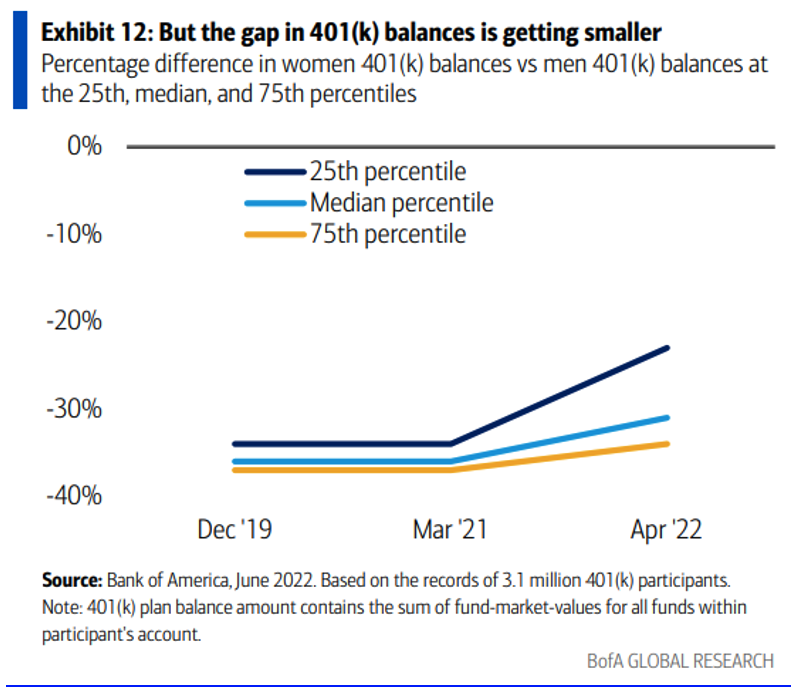

This trend extends across generations. Gen X and baby boomer women have seen the largest increases in stock market participation, with growth rates of 18% and 23%, respectively. As a result, the gender gap in 401(k) balances is narrowing, reinforcing the importance of early and consistent investing.

Women Taking Charge of Financial Decisions

Financial decision-making is evolving as well. A Bank of America analysis of Federal Reserve data reveals that 66% of Gen Z women are involved in financial decisions- outpacing their male counterparts at 60%. In contrast, older generations of women have historically been less likely to take an active role in household finances.

Conclusion

Women are stepping into a new era of financial empowerment, transforming the landscape of wealth and investing. As the Great Wealth Transfer unfolds, women’s increasing participation in financial decision-making and investing signals a transformative shift in economic power. With rising education levels, workforce representation, and a stronger presence in the stock market, women are reshaping the future of finance and closing historical wealth gaps. The future of wealth undeniably female, and as more women take control of their financial futures, their influence will not only redefine industries but also drive broader economic growth and innovation.

JR McCormick, CFP®

Certified Financial Planner™

Director of Financial Planning

Wealth Advisor

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of JR McCormick and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.